You are probably hearing the news about the failure of Silicon Valley Bank & Signature Bank and wondering: “What does this mean for me and my money?” and “Should be concerned about deposits at my bank or my investments at Fidelity?” The short answer is no. We have no concerns about your accounts – or even our own accounts!

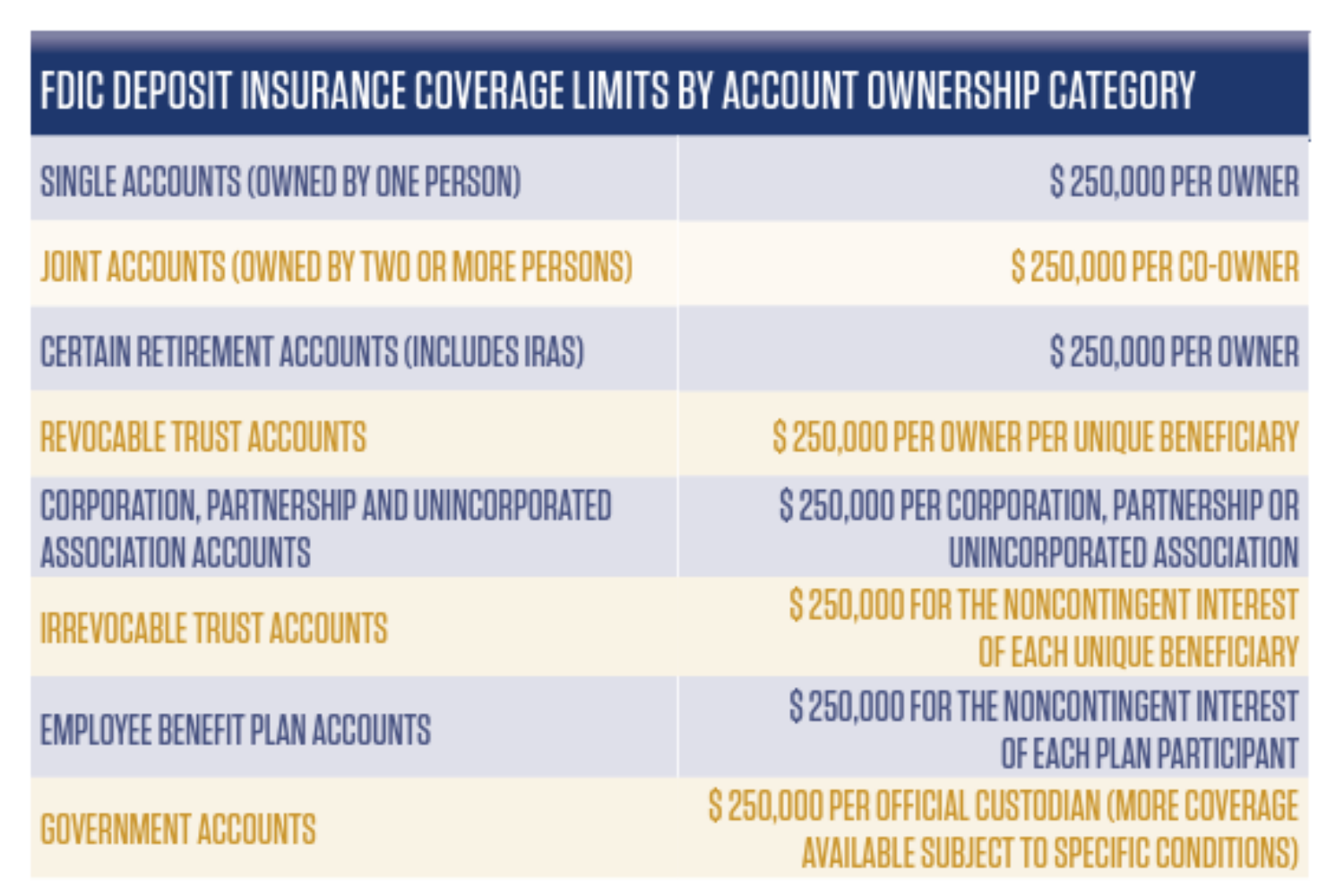

There is Federal insurance coverage for bank deposits (FDIC) and securities accounts (SIPC). As to your cash deposits at your bank, you have coverage through the FDIC (Federal Deposit Insurance Corporation). The FDIC coverage is generally $250,000 per person/per account that is covered if your bank fails. The coverage rules (including the different account types) are in the image below with more detail at this link: https://www.fdic.gov/resources/deposit-insurance/brochures/deposits-at-a-glance/

The SIPC (Securities Investor Protection Corporation) applies to your Fidelity brokerage accounts (if something ever happened to Fidelity as a company). It covers $500,000 for investments (which includes a $250,000 limit for cash). But Fidelity also carries excess liability insurance that has no individual customer limit, except for up to $1.9 million in cash awaiting investment. Fidelity has total “excess of SIPC” coverage of $1 billion. This is the maximum excess of SIPC protection currently available in the brokerage industry. Read more here: https://www.fidelity.com/why-fidelity/safeguarding-your-accounts

If you have a bank balance somewhere that is greater than $250,000 (particularly with a smaller bank), as always, we recommend dividing it between banks (or get the coverage higher with different account types) – but that is perennial advice and not just because of SVB failing.

Feel free to reach out if you want to chat about this or any other matters.