When people find out what we do for a living, we are often asked which stocks we like or what the market is going to do this year.

Our answer is always that we don’t personally own any individual stocks, or pick them for our clients. And as to “what is the market going to do this year”– their guess is as good as ours as to the short-term (i.e. 5 years or less) movement of the U.S. stock market.

People are befuddled by that answer because they believe we know, or should know, which way the market will move in any given year. It is an understandable belief, but no one knows that and if they say they do they are lying.

In reality, when we invest our clients’ money we follow what we call “evidence-based investing”—we invest based on what academic research advises is the best strategy for the long term. We want to maximize returns and lower risk as much as possible to help our clients reach their goals.

Based on researchers at Dimensional Fund Advisors (DFA), including Noble Prize winners in economics, we believe the following:

- You are very unlikely to make more money by investing in individual stocks than you are by owning a diversified portfolio of mutual funds and you are certainly taking more risk.

- The mix of those mutual funds should fall into several “asset classes” (i.e., mutual funds that own different types of investments like international stocks, American stocks, bonds, emerging market stocks, smaller company stocks, large company stocks, etc.)

- “Value” stocks outperform the rest of stocks

- A value stock is a company that has a low “Price to Book” ratio versus a similar company

- A value stock is considered a bargain–you are buying a stock that is undervalued, so you are paying less for it and getting a good deal.

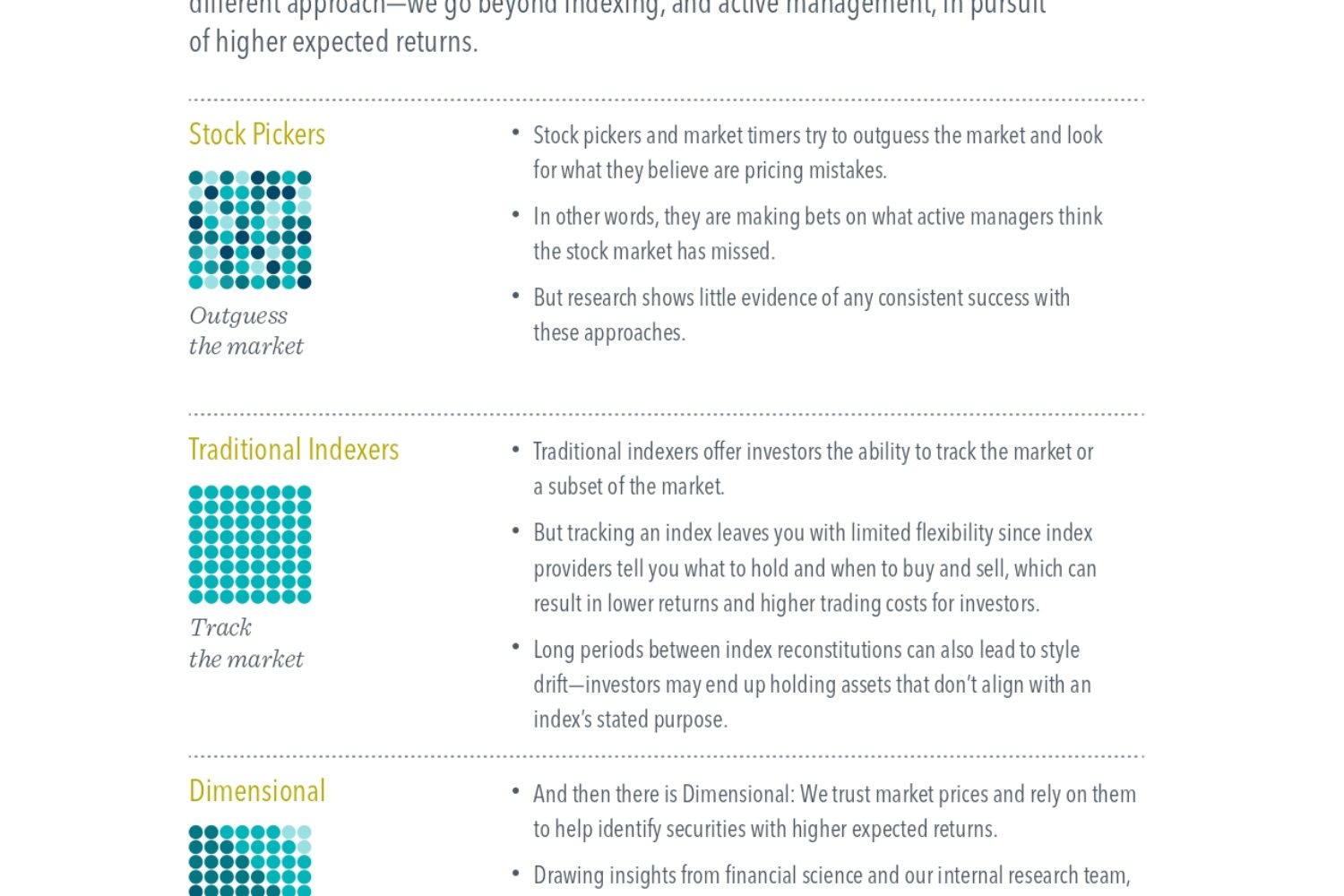

- Index Investing is good but Value Investing is better

- Index Investing is an excellent start but see the attached slide to see what Value investing does differently

There’s Stock Picking. There’s Indexing. Then There’s Dimensional Investing.

If you have questions or are ready to start building a portfolio that will help you reach your long-term goals, please click on the link and schedule a meeting today.